Let's Be Pragmatic

Panama plans to leave the BRI, Rubio raises PRC issues across Central America, Canadian report on Chinese interference, and new investments in Brazil

Welcome to Chaufa, a China-Western Hemisphere Newsletter by CPSI.

Today’s edition covers January 27 to February 10.

Listen on Spotify

The Top 5 Stories:

Owing in part to Secretary of State Marco Rubio’s trip and his warning that the U.S. would take action if there were no “immediate changes” in Sino-Panamanian ties, Panama announced it would not “renew” its membership in China’s signature Belt and Road Initiative (BRI) after the accord expires in 2026. President Mulino also confirmed that his country would audit Hong Kong-based Hutchison Ports’ operation of two ports near the canal.

Also on his trip to Central America, Secretary Rubio praised Costa Rica’s ban on Huawei in the country’s 5G network and championed Guatemala’s continued relationship with Taiwan. Regarding the former, Rubio offered to help punish officials who favor “foreign actors” (like China)” in state contracts. For the latter, Rubio called the Taiwan-Guatemala relationship “not simply a diplomatic relationship, but an economic, investment and opportunity relationship.”

Following the Trump Administration’s threats against Colombia, the Chinese ambassador continued to promote bilateral ties between Beijing and Bogota. The diplomat noted that the cultural distance “far from creating obstacles, bring us closer and enrich us.” Politico recently reported that Beijing is also interested in filling the void left by USAID’s foreign aid freeze in the South American country.

All this comes just as Colombia officially joins the Belt and Road Initiative and the two nations celebrate 45 years of relations. Relatedly, President Petro recently directed his new finance minister to weaken his country’s dependency on the United States.

A government commission released its report on China’s (and India’s) interference in Canada’s elections. The report found that Trudeau’s government was “insufficiently transparent” and took “too long to act.” However, the report did not find that the interference meaningfully impacted the outcome of the elections.

Chinese companies continue to expand in Brazil: Huaxin Cement Company entered the Brazilian market by buying its Brazilian competitor, Embu S.A. Engenharia e Comércio, for $186 million. Embu is one of the largest crushed stone mine operators in the South American country, with four quarries located in São Paulo. Meanwhile, Chinese car firm Great Wall Motors said it will open its new $1.6 billion plant in Brazil later this year.

Core Brief

Does a BRI agreement actually mean more money in LAC?

Just last week, President of Panama José Mulino said his government would not renew its participation in the Belt and Road Initiative (BRI) in 2026. In response, U.S. policymakers praised the move as “a great step forward,” while U.S.-based analysts like Ryan Berg called the decision a “win” and Margaret Myers characterized the change as “symbolic.”

A lot of hay is being made out of Panama leaving the agreement and how it could reduce Chinese influence in the country. Certainly, Myers is right to characterize Panama's withdrawal as highly symbolic — these political agreements are one of Xi Jinping’s signature policy accomplishments, so Panama’s withdrawal (even if under pressure from the United States) symbolically shows how Panama City ultimately prioritizes ties with Washington over Beijing.

That said, given that the BRI agreements never seemed to increase Chinese financing to the region, it’s not obvious if the BRI withdrawal on its own will lead to any tangible financial penalties for Panama.

A little BRI background

Launched in 2013 and largely focused on just Asia, the Middle East, and Africa, the BRI covers five policy areas: policy coordination, facilities connectivity, unimpeded trade, financial integration, and people-to-people ties. That said most focus on the “facilities connectivity” (aka infrastructure projects), “unimpeded trade”, and “financial integration” bits, as they often cover the financing (typically via loans and grants) for major new infrastructure projects around the globe that the BRI is known for.

When Panama joined the BRI right after it established ties with the PRC in 2017, it was the first Latin American or Caribbean country to join the initiative. Subsequently, most LAC countries joined the BRI in 2018 or 2019, with a couple more (namely Argentina and Colombia) trickling in much more recently. All in all, 22 LAC countries are currently BRI members.1

Have BRI agreements impacted Chinese financing in LAC?

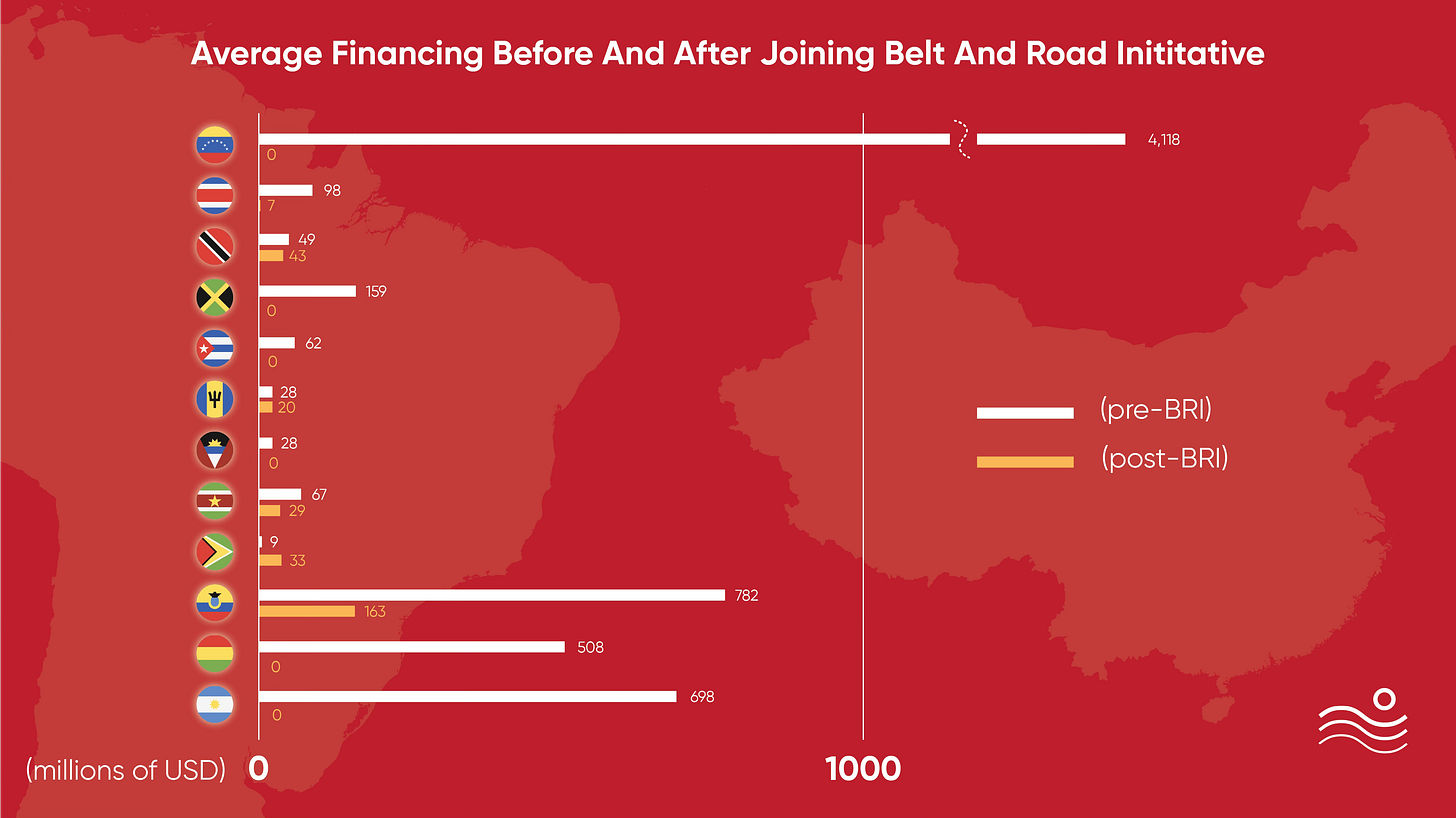

Since the BRI was launched in 2013, LAC countries received billions upon billions of dollars in loans, grants, and swaps from the PRC. But data from two key sources — one from the Inter-American Dialogue on Chinese policy bank financing, and the other from William and Mary’s AidData on a broader range of Chinese loans and grants — shows that formal agreements to join the BRI never actually led to an increase in Chinese financing.2

According to the Dialogue, in the years between when the BRI was announced (2013) and when LAC governments joined the initiative (mostly in 2018 and 2019)3, the average yearly financing that Chinese policy banks loaned to LAC governments was about $550 million.

After governments joined the BRI through 2024? The average was only $25 million. Only Guyana, which had received about $9 million a year on average before joining the BRI saw a bump after signing onto the initiative. Subsequently, its average yearly financing from Chinese policy banks rose to $33 million. Every other LAC country saw its average yearly financing from Chinese policy banks drop after formally joining the BRI.

AidData, which covers a much broader range of swaps, grants, and loans, shows the same story. In the years between 2013 and when a LAC country became a BRI member, the average financing totaled $1.53 billion per year. After joining the BRI, a LAC country’s average financing dropped to just $193 million annually. Of all the LAC governments, only Chile saw more loans and grants after its BRI membership, going from $59 million to a little more than $1 billion per year on average.4

Ultimately, both AidData’s and the Inter-American Dialogue’s data don’t show a strong relationship between signing a BRI agreement and receiving more Chinese financing. Of course, it is likely not the case that signing the agreement itself led to less financing (from COVID-19 to domestic economic changes in the PRC, there are many other reasons why this may have happened). But at least when it comes to financing, the BRI agreements themselves don’t seem to have made an obvious impact.

What does this mean for Panama?

In many ways, the term “Belt and Road Initiative” is simply a marketing term for the explosion of Chinese construction, financing, and investment around the world since Xi Jinping took office.

While there was a boom in Chinese financing throughout the region after China’s recovery from the global financial crisis, by the time LAC governments signed formal agreements to “join” the initiative, Chinese financing to the region began to decline.5

Because of this, it’s unclear if Panama will see a large drop in Chinese financing just because it plans to leave the initiative.6 Whether or not Chinese companies and institutions will refrain from financing (or trading, investing, or building) in Panama in the future probably has more to do with broader political and economic engagement rather than this one specific agreement.

The Roundup

Politics and diplomacy

The Uruguayan city of Canelones received a delegation from the Chinese city of Hulubuir in Inner Mongolia. The two cities signed an agreement on economic, livestock, tourism, and cultural cooperation.

The President of Peru’s legislature received a delegation led by the Secretary-General of the PRC National People's Congress’ Standing Committee, Yang Zhenwu.

Investment, finance, and infrastructure

After a hiccup last month when Bolivia’s legislature delayed a new Hong Kong lithium investment, a key congressional committee approved the contract signed with CBC for a project in the Uyuni salt flat.

The Ortega regime granted two new 25-year mining concessions near the Nicaraguan-Honduran border to Chinese firm Brother Metal: one for 24,612 hectares between Nueva Segovia and Madriz, the other for 6,960 hectares in Chinandega.

China Harbour Engineering Company (CHEC) won a contract to build the $11 million level crossing in Naranjo, Costa Rica.

Since a New York judge found that China Construction America (CCA) owed over $1 billion for the Baha Mar project, CCA filed for bankruptcy. The Bahamas-based BML Properties also asked the judge to investigate potential fraudulent transfers.

To reduce imports from China (and despite recent U.S. tariff threats), Swiss food company Nestle announced a new $1 billion investment in Mexico.

Trade and Technology

Uruguay’s main dairy export firm Conaprole signed an agreement with Chinese company Yili to strengthen bilateral dairy cooperation.

Leading Honduran economic official Fredis Cerrato claimed that his country’s in-negotiation Free Trade Agreement with China would not harm trade relations with the United States.

The Chinese Embassy in Georgetown noted that PRC-Guyana trade grew by more than 14% last year, reaching more than $1.4 billion.

China continues to be a major export destination for South America: Venezuela’s largest oil export destination, with a 21% increase in exports in January compared to December, while Peru’s avocado exports grew by 40% last year.

Chilean cherry producers faced a crisis recently when 1,300 containers with 5 million boxes of cherries worth were delayed, possibly costing them up to $130 million.

Taiwan

Belize will defer payment on ten loans from Taiwan for another three years due to “cash flow” problems.

Taiwan officially launched a new rice donation project and a public health cooperation project in Guatemalan cooperation with U.S. and Catholic charities.

The ROC’s and Haiti’s health ministers chatted on the sidelines of the World Health Organization (WHO) to discuss health cooperation.

Taiwan’s new ambassador to St. Lucia, Nicole Su, officially took up her new post. She previously served in St. Vincent and was mostly posted in Geneva. Meanwhile, a new joint medical mission from the United States and Taiwan will arrive later this month.

Society and culture

Chinese-descendent communities across Latin America celebrated the Year of the Snake with festivals and parades, including in Mexico City, Panama, and the Dominican Republic. PRC embassies and civil society organizations also hosted gatherings with senior LAC leaders in countries like Antigua and Barbuda, Bahamas, Ecuador, Guyana, and Jamaica.

PRC United Front organization Jamaica-China Council for the Promotion of Peaceful National Reunification donated 11 tablet computers to primary schools in Montego Bay.

Analysis and Opinion

Typically conservative and hawkish Wall Street Journal columnist Mary Anastasia O’Grady criticized the Trump Administration’s Panama policy, writing that “The president claims Chinese soldiers are working in the canal. That’s nonsense.”

Kate Linthicum and Stephanie Yang write in the Los Angeles Times that “experts say China has been handed another opportunity in its quest to dominate the [Latin American and Caribbean] region: the presidency of Donald Trump.”

The Atlantic has a piece by Quico Toro on how “Trump’s Colombia spat is a gift to China,” noting that “Latin American leaders don’t like submitting to the United States in imperial mode [and that] they also have an alternative.”

Former Mexican Ambassador Arturo Sarukhan wrote in Americas Quarterly that “If the North American trade edifice unravels or is torn asunder because of tit-for-tat trade disputes and the potential demolition of the USMCA, the only winner will be China.”

Clovis Nelson argues in the Jamaica Observer that Jamaica is “leveraging the advantages of Chinese investment while ensuring the protection and promotion of national interests. Concurrently, the relative disengagement of the United States from the Caribbean has created a space that China has adeptly filled.”

Dialogue Earth published an analysis by Javier Lewkowicz on how Argentine provinces are intensifying their relationship with China.

Recent academic publications on China-Latin American ties include an article by Evan Ellis in the Journal of the Americas on “China, the Illiberal Counter-Order, and the Role of Values in the Strategic Response” and an article in Great Power Competition Volume 6 on “China’s Expanding Role in Latin America’s Defense, Aerospace, and Telecommunications” by Alvaro Mendez & Gaspard Estrada.

That’s it for now, see you again in two weeks!

Make sure you don’t miss the next issue of Chaufa 👇

Of these 22 countries, 17 governments previously had relations with Beijing before signing BRI agreements. For the following analysis, I’m going to exclude the countries that only signed agreements when they established diplomatic relations (Panama, Dominican Republic, El Salvador, Honduras, Nicaragua). This is because it wouldn’t make sense to compare Chinese investment and financing in these countries before they had diplomatic relations with Beijing.

If you’d like to see the spreadsheet with this data, just email me at ethan@cpsi.org.

These yearly financing averages come from the amount between when the BRI was first announced (2013) and when any given country joined the agreement (2018 or 2019 in every case but Argentina’s). For that reason, the pre-and post-BRI membership number of years varies between countries. The year a country joined the BRI is included in the post-BRI membership timeframe.

This is mostly because of $3 billion in financing in 2018, which is the year that Chile joined the BRI.

There are a lot of non-LAC-specific reasons for this, including China’s economic slowdown, the COVID-19 pandemic, and concerns about the reliability of developing markets.

While not all Chinese-built projects or investments are financed by PRC institutions, many are, so financing can be a good (very very rough) proxy for continued Chinese economic influence moving forward.